There is no doubt that over the years, Sales & Operations Planning (S&OP) has brought companies around the world many valuable business improvements. This article argues that after existing for over 30 years, the development of S&OP as an end to end business management process method has come to a standstill. This standstill is threatening the very existence of S&OP. The only way to further mature S&OP is to academically define it, govern it and integrate it with other academic disciplines.

The times since Sales & Operations planning (S&OP) was born in 1987 as a solution for operational issues are long gone. Back then, connecting sales with a Material Requirements Planning (MRP) run was a first attempt from operations to integrate functions and achieve some business alignment and joined decision making.

Since that time, the scope of S&OP has significantly increased. Demand management, feasible supply and capacity planning, product portfolio management, financial integration, customer and supplier integration and resource management amongst others have all been added to make S&OP a more complete and value adding business process. Over the years S&OP has made a lot of improvements and added value for numerous businesses in the world.

Although still mostly deployed in the manufacturing industry, S&OP as an advanced planning & forecasting process is now a much sought after capability for many businesses. More and more articles on S&OP are released, S&OP is being discussed on social media, more IT and service suppliers are using S&OP in their value proposition. Some even say that after 30 years, S&OP is having a renaissance

The pitfall in S&OP development

In practising S&OP for the last 15 years and researching and writing about it for the last five years, I have noticed that the development of S&OP has stalled. In the last 5 or even 10 years nothing new has come to this business process. Worse even, the term S&OP has become a commodity, a thing everybody talks about but few know about, like an overbought stock advised by a cab driver. It is now a marketing gimmick for any vendor that offers something only slightly related to S&OP.

To add to the confusion we have given S&OP new names like Sales, Inventory and Operations Planning (SIOP), Integrated Business Management (IBM) or Integrate Business Planning (IBP) to name only a few. A lot of time has been spent in blogs, articles, conferences and whitepapers to explain the difference in those names. This time would have better been spent on how to improve S&OP.

Of course we can’t say that no progress has been made at all. In process we might have added a bit more scope or detail like demand shaping and sensing. In IT, solution providers have given us clever S&OP cockpits, scenario and simulation capability and added collaboration and social functionality to our planning systems. Consultancies with S&OP in their offering started talking about the importance of people and behaviour, but hardly any consultancy came up with solutions. For S&OP as a business management capability, few of these changes can be called significant developments that contributed to better end to end business management for the highest executive level.

Most improvements in S&OP have a common denominator. And this has also been a common pitfall in the development of S&OP as aligned and integrated business management method. It is a pitfall I’ve observed in language from business leaders, practitioners and consultancies. A couple of exception excluded, it is a pitfall I noticed in articles from many S&OP thought leaders and academics. This pitfall is holding S&OP back from further maturing as an end to end business management capability.

I call this pitfall the supply chain bias!

Over the last 30 years, S&OP has been developed as a supply chain capability, not as an end to end business capability. S&OP thought leaders, consultancies and practitioners have had a significant supply chain bias and still do. S&OP LinkedIn groups are mostly joined by planners or people with a supply chain background. The same holds for participants in S&OP conferences. S&OP consultancies mostly have a supply chain background. S&OP is widely discussed in the supply chain community, but not widely acknowledged in other business communities. Academics that discuss S&OP are mostly operations, logistics or supply chain academics.

Outside this little bubble of the manufacturing industry and the supply chain and logistics world, S&OP has gone by mostly unnoticed in the rest of the world for almost 30 years. This has stalled the holistic development of S&OP.

How to further develop S&OP

To further develop S&OP needs to let go of its focus on supply chain language and improvements. S&OP has to start doing what it has been advocating within businesses since its inception in 1987. Organize and govern in a disciplined way and integrate and cross silos with other industries, business functions and academic disciplines. These are two ways in which we have to improve S&OP.

- Organize and govern S&OP: within the academic, business and supply chain world S&OP is not organised and governed well. There are no common agreements, definitions, metrics or certifications. Anything goes and can be called S&OP. Patrick Bower’s article ‘Integrated Business Planning: is it a hoax or here to stay’ provides great solutions how to advance S&OP and its governing. Creating a governing model is a much needed next step, but it will not be enough for S&OP to survive.

- Integrate S&OP with other disciplines: for S&OP to survive as an end to end business model, we need to look at how other business functions or academic disciplines can support further development. We need to think holistic and create a model that solves the core planning objectives every business has. We need to cross the silos and engage with other academic and business disciplines to advance S&OP thinking, make it more valuable and keep it relevant.

At the highest level, the core planning objectives of a business are the same. Companies are simply here in the world to fulfil their purpose and execute their vision. The vision is their long term aspiration and the starting point for every business plan. Given a business has a vision and a strategy, the core planning objectives becomes to make that vision a reality by making great plans that connect vision, strategy and annual plans with execution. With the right development, S&OP is well positioned to take on this planning role.

Where to integrate S&OP with other disciplines

S&OP well done has at least four outcomes to provide visibility and support to the execution of a company vision. It is in these four areas where S&OP needs to integrate and learn from other disciplines to improve as end to end business planning process

1. A feasible rolling forecast and budget:

This provides executives periodically with an updated feasible Profit and Loss (P&L) statement, working capital, cash flows, gaps to budget and scenarios on business risks and opportunities across the most important P&L lines.

The academic and business history of financial planning & forecasting started before S&OP came to life. Finance and supply chain integration and cross learning grew when Supply Chain Finance development academically as well as in business. You can find some finance publications that show an interest in S&OP or Integrated Business Planning, but the finance community usually talks about rolling forecasting & budgeting, zero-based budgeting or driver based forecasting.

The 2003 article ‘Who Needs a budget’ discusses rolling forecasting that was applied in the 70’s in the banking industry. Long before S&OP was born. More recent in the 2014 article ‘Managing the strategic journey’ McKinsey argues that to connect strategy with execution “one important capability that companies must develop … is rolling forecasting and budgeting”. The strategy and finance community use common language where S&OP usually doesn’t get a mention.

2. A check against strategic intent

Strategy plans are active in current budget year and beyond the budget horizon. S&OP done well, peeks beyond the budget horizon and has a look at next year’s budget and strategic initiatives.

Strategy and strategic planning also have a longer history than S&OP. Many theories on how to link strategy with execution have been published, Kaplan and Norton‘s business balance scorecard amongst the well-known. In the 2006 whitepaper ‘Creating the office of strategy management’, Kaplan and Norton suggest an integrated planning model to connect strategy to rolling forecasting & budgeting, workforce planning and execution. This paper describes at a high level, everything S&OP could be, but S&OP is not mentioned.

S&OP at its best can play a significant role in connecting strategy with execution. Yet, in dozens of strategy articles from McKinsey, the world most famous strategy consultancy, S&OP is not mentioned once. Similar to the finance community, McKinsey and Kaplan & Norton do use the term rolling forecasting & budgeting.

3. Updated resource allocation

Changes in the workforce or resources requirement for business as usual operations, budget or strategic initiatives, provide executives the opportunity to re-allocate resource where they add most value.

With its traditional background in operations, S&OP consultancies and practitioners seem well equipped to use logic and algorithms to apply resource allocation as outcome of an S&OP cycle. However resource allocation is also a topic strategy consultancy and academics spend significant time on. S&OP can learn a lot from cross business unit resource allocation discussion as in the 2013 McKinsey article; ‘Avoiding the quicksand; ten techniques for more agile corporate, resource allocation’. Besides giving many useful references on corporate resource allocation, this article discusses research that shows that 90% of corporate resource allocation don’t change year on year. However, companies that reallocated more resources earned, on average, 30 percent higher total returns to shareholders. Needless to say, dynamic resource allocation is paramount and there are many other academic and business articles and whitepapers to leverage from to improve S&OP thinking.

4. Communication with execution

Well-defined communication strategy gives executives the opportunity to inform and refocus their employees and keep them engaged with changes in strategy, resourcing and budget plans. I make a strong case for communication in my Foresight article an S&OP communication plan: the final step in support of strategy execution

A plan needs to be executed at one point of time. Using an internal S&OP communication strategy to address the right stakeholders with the right information through the right channel at the right time can have a powerful impact and keep employees engaged with strategy, budget, resource allocation and execution in a structured way. In the 2008 article ‘The secrets of successful strategy execution’, Gary L. Neilson and others address the importance of communication and suggest that information flow is the strongest contributor to good strategy execution. To further improve and play a role in strategy execution, S&OP has to understand the changing communication needs of employees and S&OP needs to start developing an integrated communication strategy as part of its model.

5. Mindset and Behaviours

To achieve these four advanced S&OP outcomes and meet business planning objectives, there is a fifth element required to achieve sustainable and advanced S&OP. A cultural change!

Before starting an S&OP change program, which according to many experts can take 5-10 years to master, advanced and sustainable S&OP has to address the only guidance in the strategic horizon, namely the company purpose, vision, values and behaviours. As Collins and Porras suggest in ‘Build to last’, we can call this; company culture.

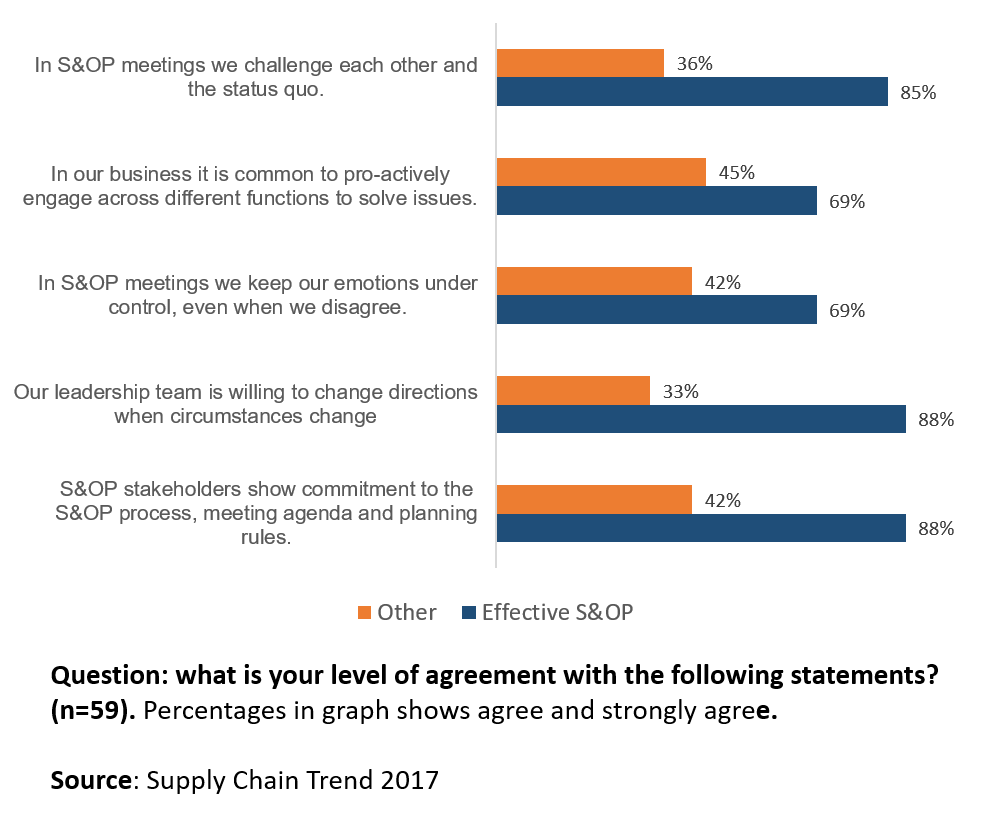

More specifically, within a company culture, a change is needed in mindset and behaviours. My S&OP Pulse check indicates a clear relation between effective mindset, behaviours and effective S&OP. Below graph shows how attributes from a Mentally Tough – or a winning – mindset contributes to effective S&OP.

To implement S&OP, businesses have to go through a major transformation of alignment, structure, discipline, transparency and cross functional team work. This requires a mindset change for many people and sometimes a whole business. Often many little kingdoms or tribes have to fall and make place for commitment, cooperation and collaboration, listening, empathy, challenge, conflict resolution and effective decision making. This requires an effective mindset and behaviours as part of the company culture.

To develop S&OP further and stay relevant, the S&OP community has to start reaching out, integrate, learn from the five business disciplines of behaviours, strategy, rolling forecasting & budgeting, resource allocation and communication.

The fall of S&OP

In ecology, the competitive exclusion principle states that two species competing for the same resource cannot coexist. The specie with only the slightest advantage over the other will dominate in the long term. Similar to this principle, S&OP has to evolve to become the unquestionable number one business planning model. This needs to be across all disciplines and industries, not only in the supply chain discipline and manufacturing industry. If not, another discipline like finance or strategy will get the advantage and take over S&OP in the long run.

As we’ve seen happen to many companies and industries in recent years, a new disruptive idea or development will take its place. Strategy and finance communities will create a new end to end business model that will replace S&OP. Whilst the S&OP community is discussing what acronym to use for its model, the strategy and finance disciplines already use common language and definitions for rolling forecasting & budgeting and have been publishing research that connects culture, strategy, finance, communication and execution for years.

The articles referred to earlier are just some of the dozens of examples from very serious strategy and finance academics and consultancies trying to solve the same puzzle as S&OP. Where S&OP is stalled academically and does not get a lot of serious research support, strategy and finance academics and consultancies seem to be better resourced, more focused and show visible progress. If this continuous, it will only be a matter of time before they present a rolling forecasting & budgeting variant as the new worldwide accepted end to end business planning model.

When they do, S&OP will slowly become redundant and will only remain as an academic footnote. S&OP will be a great idea in the history of business planning that never came fully to fruition.

very nice message ! I would summarize by saying what is needed is to educate 90 percent of business leaders to know what they don’t know. That is an S&OP measurement management planning system, cultural bias is the answer to many of their challenges

Good article.

Gartner tell us most S&OP processes never get beyond stage 2 of 5.

In my experience thats manifested in a process that is backward looking and crisis orientated (“why do we have these service/cost/inventory problems and what are we going to do about them?”) instead of a stratgic focus.

Reason is that S&OP fails to forecast the unintended buffer (time, capacity, inventory) created by the forecast error generated variability blown in to the SC via DRP/MRP (see Factory Physics- Q=VUT)

Eliminate this source of Variability by using Demand Driven replenishment (“a segmented multi-echelon supply chain re-order process characterised by multiple deliberately planned, but independent, inventory positions that are autonomously replenished, in an efficient and stable sequence, to a calculated stock target in line with real demand – not the forecast”) and S&OP plans will become accurate, the day to day SC performance problems will disappear and S&OP will become the useful strategic forum its supposed to be – and C suite execs will start to attend?

Good article.

Gartner tell us most S&OP processes never get beyond stage 2 of 5.

In my experience thats manifested in a process that is backward looking and crisis orientated (“why do we have these service/cost/inventory problems and what are we going to do about them?”) instead of a stratgic focus.

Reason is that S&OP fails to forecast the unintended buffer (time, capacity, inventory) created by the forecast error generated variability blown in to the SC via DRP/MRP (see Factory Physics- Q=VUT)

Eliminate this source of Variability by using Demand Driven replenishment (“a segmented multi-echelon supply chain re-order process characterised by multiple deliberately planned, but independent, inventory positions that are autonomously replenished, in an efficient and stable sequence, to a calculated stock target in line with real demand – not the forecast”) and S&OP plans will become accurate, the day to day SC performance problems will disappear and S&OP will become the useful strategic forum its supposed to be – and C suite execs will start to attend?

See https://www.linkedin.com/pulse/20140823214006-2206374-why-all-the-supply-chain-focus-on-s-op?trk=mp-reader-card

Very nice article. Aside from other replies on why S&OP process have a difficulty to reach level 5 in the set-up used by Gartner I very rarely see S&OP being fitted in the bigger picture of management. There is a missing view on how the S&OP process (or as mentioned in the articale whichever name is used) are fitting in the total managerial steering model or governance used. The S&OP process is but one of a total set of processes which enable a company or a unit of a company to steer and manage.

So from the point of view on the academic area which looks at how companies are run by managers or leaders on a operational, tactical and strategic levels there is in my opinion a clear need to further academically define the process.

Good article. S&OP has already come a long way. Its main benefit is alignment of functions usually chasing different objectives and providing different answers to classical tradeoffs. The obvious link or support should be with the Financial community for whom S&OP also makes the link between financial figures and operations. Supply Chain and Finance are the two functions having the greatest interest in unbiased forecast or plan. As a supply chain person, I consider Finance as a key ally in S&OP process.

And by the way, there is now a certification in S&OP, managed by the S&OP Institute under the moral authority of Thomas Wallace.

Thanks for all your comments. Very much appreciated!

@John: you might not be far of with your estimate of 90%! We got a long way the go and we won’t give up!

@Simon: managing and improving demand variability will remain a challenge forever in any end to end business planning model for sure.

@Arnaud: Gartner’s 5 levels used to be 4 levels, a maturity model I still prefer. There are a couple of dozen other maturity models out there. Now what is the right one? I use a combination of a couple.

I think you hit the nail when you say that S&OP is rarely positioned or well fitted in the overall end to end management of a business. Which is the place where it needs to be to be effective. That’s pretty much the point from the article as well.

@Herve: S&OP has come a long way indeed. Mr Wallace is one of the few that included academics in his early papers and articles. His early work was ground-breaking for S&OP I dare say. I know he does provide S&OP certification, so does APICS and a handful of other organizations and consultancies.

Hi Niels,

A key part of the problem actually lies deeper – supply chain strategy, a.k.a. “agile delivery” – not the only but certainly a core strategy S&OP is attempting to plan and execute – is rarely explicitly mentioned within overall business strategies.

S&OP is trying to form part of a jigsaw puzzle whilst C-level is playing backgammon. And the pieces of these two different games do not match each other at most companies.

I recently attempted to rectify this academic shortcoming in attached paper – http://www.emeraldinsight.com/doi/abs/10.1108/JBS-04-2014-0042 (abstract only visible).

So yes, the academic definition of S&OP definitely needs tightening up, but such a task will be insufficient in and of itself until business strategy is freed from its chains of being a predominantly innovation-marketing-finance play thing and supply chain agility becomes part of the C-level strategic dialogue.

Very good. Thanks for the simple steps. I first saw your article’s title, and thought, “oh, like the death of ‘lean’ manufacturing!?” Lean is not dead, nor is the need for it. It just has not been implemented ‘holistically’ as you suggest S&OP has not been.

Thank you again for the simple steps forward, and not just the fluff.

Take care,

rd

S&OP is what the employees in the company make out of it.

We have a multitude of definitions &metrics and our colleagues find reasons to explain variances from best practices.

S&OP preaches one nr forecasting across the company and that one is driven by … finance. In this perspective I choose for a different forecasts to drive replenishment.

We should also consider the many “cooks’ in the company that influence best practice process set-up and dilute its output to maintain their influence.

I feel for generic rules companies can use and would be happy with academic input whenever it is practical.

In a nut shell : we have challenges ahead 🙂

Radu

GDay Niels, I enjoyed reading your perspective, and hope it provokes even more interest, comment and action to push it forward as a primary business planning method. I am not convinced that involvement from academia will advance the use of S&OP in all businesses, but agree that more education at the tertiary and even the secondary level to orient business models for career development is a useful objective.

We talk much about breaking down the silos, and collaborating across the functions of the business, but I do not see enough of this actually happening, and is in my opinion why S&OP usage generally is stalling in some organisations. The involvement of finance in this process to arrive at a single plan is indeed pleasing, and needs even more encouragement. Supply Chain does not own S&OP, the business does, so even this collaboration seems to be held back by the ego driven need for functional ownership of great tools that drive the business. Our traditional managers still follow old methods, and need more of your coaching to help recognise the significant value good S&OP will provide. Go straight to the bottom line!!

Peter Lomman

apicsAU

Thanks for your feedback and kind comments Peter.

Provoking some more discussion is indeed an important part of why I write these articles. It might help push thing forward. To me involvement of academia will create a solid structure or anchor point from where we can move forward as well.

S&OP stalls indeed because of silo behavior. I wrote a lot about crossing the silo’s. It is a hard thing for us human beings. Many of us prefer to be save in our comfort zone where we know how things work. Crossing silo’s needs higher common goals, curiosity and then a willingness to share your turf and grow together with other people or functions.

I believe this is a mindset and behavioral skill which can be coached. I also think businesses can actually recruit on these mindset and behavioral skills to create critical mass of people that pro actively cross silo’s.

cheers,

Niels

Very good article. However, before we start to look at new innovations in S&OP, it is important to address why S&OP does not advance beyond supply and demand balancing for the majority of organisations. I really hate to be boring, however, the most important factors are accountability, P&L alignment and governance.

Another point you raise is whether S&OP becomes a relic – undoubtedly there will be some new name at some time in the future. However, there is a really good reason why S&OP or IBP should be a process coordinated by the supply chain – my research shows clearly that where S&OP is owned by the commercial planning organisation, there is significant forecast bias as plans are adjusted to match sales targets, if it is owned by finance, there is still a bias (although less) as plans are adjusted to match revenue targets, it is only when the process is coordinated by the supply chain that the level of forecast bias is reduced. However, where supply chain reports to, or is closely aligned with manufacturing or procurement then lack of trust becomes a major factor.

Thanks Matthew,

have a look in an other blog of mine https://supplychaintrend.com/2015/11/25/a-new-definition-for-integrated-business-planning/

where a group of commentators is well aligned that the main issue is that there is no academic foundation or definition for either S&OP or IBP. From a practitioner point of view I can agree with the outcomes of your research and it aligns with my experience. Thinking forward, for me it is pure logic, to realize S&OP needs to engage with other business functions and the academic world to make true progress and create true knowlegde.

Don’t take this personal, but to be honest, I’m getting beyond the point of caring what Gartner and other powerful parties have to say, until they make an effort to be true thought leaders and make S&OP and IBP academically sound.

Without a proper academic definition S&OP and IBP can be anything to anybody at any time for any purpose….and unfortunately this shows!

Hi Nils, I only just read your comment, 6 months later, however, I do actually agree with you, and have had this conversation with other “powerful parties” that there needs to be a supply chain driven definition of S&OP and IBP. I have also been working with a former supply chain executive, who recently conducted a PhD on S&OP and is now a university lecturer – it is actually very difficult to get even supply chain academics to understand the need for S&OP and to take it seriously as a proper subject.

Totday I read the latest comment. I relate S&OP or IBP to an element broader than supply chain. I have not done academic research but to me S&OP is a type of management governance planing & control structure at a tactical level. Similar structures are needed to manage other business areas such as finance or R&D to ensure it meets the company’s goals, adds value to the customers and the company.

Thanks Matthew. I know, the first academic paper on S&OP was in 2002, about 25 year after its inception. So how serious a topic is it really?

On an other note. Just saw that you do triathlons! Good one. I did a sprint (750m, 20k, 5k) last year which I really enjoyed. Going for a couple more next summer season.

Cheers,

Niels

Hi Arnaud, thanks for your feedback. I’m in full agreement with you. It is a governance structure, where a business checks and balances it’s operational plan, latest forecast and its strategic intent.

Cheers,

Niels

Niels

Good stuff… seems like your article is in line with our dialog that 90% of business leaders don’t know what they don’t know. (e.g. don’t know what S&OP can do for their business ?) I am convinced with will not move with selling and pushing tweaks in description to folks who already understand S&OP. It happens as you mention in soe of your points in getting concepts into general business community

S&OP is NOT the goal the goal is throughput, profits, efficient use of resources with maximum cashflow and great ROA / use of working capital. All this in context of being competitive…hopefully more competitive then your competition in the eyes of the customer

It is time to develop, exploit and USE technology to bring awareness of how much better companies can perform vs. current state is once there is GREAT S&OP leadership technology might be used to sustain and scale. Software market has it all backwards 🙂

We have patented a real time S&OP technology we call Order Commitment which is a step in this direction. Now working on advanced technologies to let any role in a business (not just planners) work to manage lead time vs. cost for entire “assemblies”

Give us a shout at info@dcrasolutions / http://www.DCRASolutions.com for more insight.

Hi Niels, just came across this 2 years’ old (but still very actual) article that I read with interest. By analysing the situation for the CPG/FMCG companies we work for – I agree with you that S&OP is “stuck”. No innovations, just name changes to IBP… also I understand from S&OP leaders and all reports that I read recently that supply chain does not come across to CEOs and that now, even for the last years, finance becomes “competitor” as doing their own forecasting/planning and thus putting S&OP numbers and processes at jeopardy. I think the main problem is that S&OP is boring to the top management. We are talking about supply chain, bias, KPIs, etc. – whereas the top management talks sales – and often in million $ and not in units. And I feel that we – S&OP people alike – have simply forgotten the “S” in S&OP: SALES. Sales drives production demand and thus profits. If we were to emphasise the sales aspects an how much sales can be achieved with best-in-class S&OP, by focusing on 1 number, ensuring the old, simple idea to having products ready on time to sell – and ensuing we don’t lose sales to competitors, the management board, whose only focus is to cover the next budget or latest quarterly estimate, would finally listen and consider us. Instead we want more industry standards, create new words – and bore all but us, S&OP and supply chain people. In all responses to this very good article I get the bitter feeling of frustration but only 1 (the last one promoting probably their software) is talking that S&OP is not the goal, but the goal is profit – with S&OP. And therefore to conclude, I think we need to go a few steps back and market again internally why S&OP is here for: to support the sales, to make sales and profits – and not for the sake of getting a scientific art for just the few of us…

Thanks Rolando. I agree it is boring for non supply chain execs. I’m not into the S for sales thing. I would say get a continuous rolling forecast on EBIT, an S for strategy. That’s how you get exec interest. Then add a C for communicating both to your employees then you can use the & for employee engagement. Employees who understand and feel connected to the strategy are more engaged. How is that for a goal for S&OP??? Read my Foresight articles if you like to know the details behind my thinking. Cheers niels