“There is only one way to eat an elephant: a bite at a time.”

Desmond Tutu

Outside-in thinking in theory

Outside-in thinking makes sense. It has been suggested to include a market, customer, and competitor view in a strategy definition for more than 50 years. It is not new in strategy.

It is not new in supply chain management either. Lee’s uncertainty framework (2002) shows how to segment your supply chain in demand streams and how to define your supply chain response to that. Elegantly put in a two by two we all love.

John Gattorna’s Dynamic supply chains, delivering value through people (2010), describes in more detail, not only how to segment your supply chain in different customer driven streams and how to respond, but also what capabilities would be required in the organization. He even suggests having two parallel organizational capabilities. One for BAU, efficient supply chains without too much variation, and one for highly variable supply chains, which require an agile or responsive supply chain response. They are different teams, with different mindsets, priorities, and capabilities. If you critically think through it, the full scope of outside-in planning is a bit of an elephant.

Outside-in planning in practice

As per usual, in practice it is all a bit harder. As a young dairy S&OP manager about 15 years ago, I used Lee’s approach in the schematic below to explain to a supply chain executive why our one trick approach to planning & response didn’t meet our customer service targets. This was part of a 22-page planning improvement PPT.

As per Gattorna’s view, the market driven demand segmentation and the matching of a supply response will require a supporting supply chain network and operating model. I explained what type of changes were required in our operating model, including technology, without success.

I was happy with my analysis, and so was my direct manager. But we could not convince the executive on why we had to segment our supply chain and change some of our capabilities. Maybe I didn’t explain it well, maybe he didn’t understand, maybe he didn’t care. Most probably he thought it was just too theoretical and too hard a problem to tackle.

I chewed off a bit from the outside-in planning elephant and was pleased with the insights. I went along and tried to configure our two different SAP APO instances as best as I could to support my segmentation analysis.

Current outside-in planning advocacy

Lora Cecere is one of the strongest proponents of outside-in thinking, I admire her for that, and I support her in that. She defines outside in planning as;

“Modeling based on channel and supply network signals. The translation of market signals from the customer’s customer to the supplier’s supplier with bi-directional flows.”

This definition pretty much describes what Gattorna means with dynamic supply chains, but without going into detail to define the complexity of the underlying operating model (the how) that is required to support it. An operating model is not limited to organizational design, roles & responsibilities, KPIs, incentives, culture (mindset & behaviours), processes, technology, the list goes on.

Where to start for the practitioner

To start with outside in, Lora suggests a variant of Lee’s model uncertainty framework as per the schematic below. I fully agree this is a good start to create insight and awareness indeed and pretty much what I suggested to the executive all those years ago (Yes, I made a supply and demand variance analysis underneath that PowerPoint slide). It is a first, simple bite out of the elephant.

A project approach to eat an elephant

A project called Zebra, where Lora played a key role, was an effort across software vendor, academics, and industry practitioners to define an outside-in planning process model. It had an admirable scope, probably a bit too big as you can see in below schematics (both Youtube screenshots)

The addition to Lee’s and Gattorna’s thinking, is the bi-directional automation of what they’ve proposed plus the vertical integration (include strategy via a balanced scorecard) plus the horizontal integration (include your supplier’s suppler and your customer’s customer, if relevant).

Mind you, this still only describes what it is, not how we’re going to do it and maintain it. These are not new ideas, but combined and automated it is a certainly a new approach and a massive elephant.

The capability needs as defined by the project team were very technology focused as you can see in above schematic, only describing one bite of the elephant outside-in operating model. About outside-in planning technology, Lora says on LinkedIn “The technology solutions currently in development will take a couple of years, but now is the time to get ready”.

What??? A couple of years??? For an immature technology, that probably takes another two years to deploy. So, in five years from now we will have our first outside-in technology offering? Who’s going to wait for that?

Zebra probably couldn’t eat the elephant because of the scale, ambition and therefore size of it. The last Zebra video I saw on Youtube was about a forecasting use case and how FVA improved by using more market influencers in the forecast model. Forecasting is only a very small bite out of the outside-in elephant. As we speak, there are forecasting use cases where a global CPG does the forecast for global retailers in multiple markets on store/sku/day level for both sell-in and sell-out. That’s pretty much outside in forecasting at a global scale. That outside-in point has been proven.

A decision centric approach

In the blog How to jump Lora highlights that “The opportunity is to make better decisions while reducing the time to make a decision (latency)—time to sense and respond to market shifts”.

As Decision Intelligence editor at Foresight, I certainly agree with faster and better decisions. Over the yearsI describe in several article and recently in my blog decision centric IBP is becoming a reality that we want to make better quality decisions, record decisions, and learn from decisions. We want to make those decisions, with less time in meetings, less analytics waste and more employee engagement in the decision process. For this, we have to become more decision centric, and introduce decision centric capabilities. Decision centricity is missing in the current definitions and thinking around outside-in planning.

So, what decisions need to be supported? As I highlight in below slide which I discussed in detail in a Foresight article, there are different drivers that define process & decision automation, augmentation and human involvement.

A key observation from the oitside-in demand segmentation is that most of the demand streams need an agile response. Which is to be “able to move quickly and easily.” when I look at the online dictionary.

These response decisions will be mostly in the shorter term (S&OE) horizon. There are too many, too frequent for planners to address withing a short time frame, even more so given that IDC estimates that 50% of data decays within hours. These decisions need high levels of automation. Gartner estimates that 65% of short-term supply-chain decisions will be automated by 2026.

There might be a reason why former Chief Supply Chain Officer from Unilever, Marc Engel, declared that investing in agility, which he defines as quickly sensing change and responding to it, gives in his opinion a 10X return versus investing in forecasting and scenario planning.

To proof outside-in planning & decision making, we have to overcome what Gartner calls ‘the decision divide’. This is the gap between planning, data & analytics and business value. This can only be overcome by decisions and action, not by planning only. If we can proof outside-in planning for short-term decisions and actions, it is reasonable to assume we can do it for longer term decisions.

A bite-size approach to outside-in

To make progress with outside-in planning & decision making, I suggest not waiting five years for a new technology to arrive. I suggest to keep the vision, which is great, but changing the scope and take a bite size approach to outside in decision making:

Strategy integration (through balanced scorecard): relevant, but not required to prove the concept of bi-directional demand & supply orchestration.

E2E scope: drop second-tier or third-tier customers and suppliers for now. These can be added later once the concept has been proven with the first tier.

Decision types: short-term supply chain decisions, S&OE decision. Leave medium term, tactical or strategic decision out of scope for now. Focus on fast, agile, consistent, high-quality decisions and actions to demand or supply disruption.

Demand & Supply Stream: pick one or two relevant demand streams (Lora defines 7) and a few decision within those to prove the concept. That will automatically indicate what supply stream (response type) is in scope.

Demand streams: Products in a portfolio, segmented in demand streams, will not often swap demand streams. A seasonal product remains seasonal, a tail product likely stays in the tail. But anyway, with current technology we can automatically detect changes and realign the demand streams according to the market indicators we want.

Supply streams: The supply response, or strategy on how to respond to a demand stream, doesn’t change. It’s either efficient, agile, or responsive. What we do have to do is automatically detect issues to respond to the demand stream and indicate that to a planner or integrate it in an automated decision process. This is possible with current technology.

Continuous bi-directional: With products hardly changing demand streams, I’m not sure we should spend a lot of effort to continuously remodel this. What’s more important is to define the demand and supply triggers that require a supply chain decision and action and orchestrate those decisions between demand & supply in a smart workflow. Some thinking needs to be done about what this really means in a data-to-decision-to-action making process.

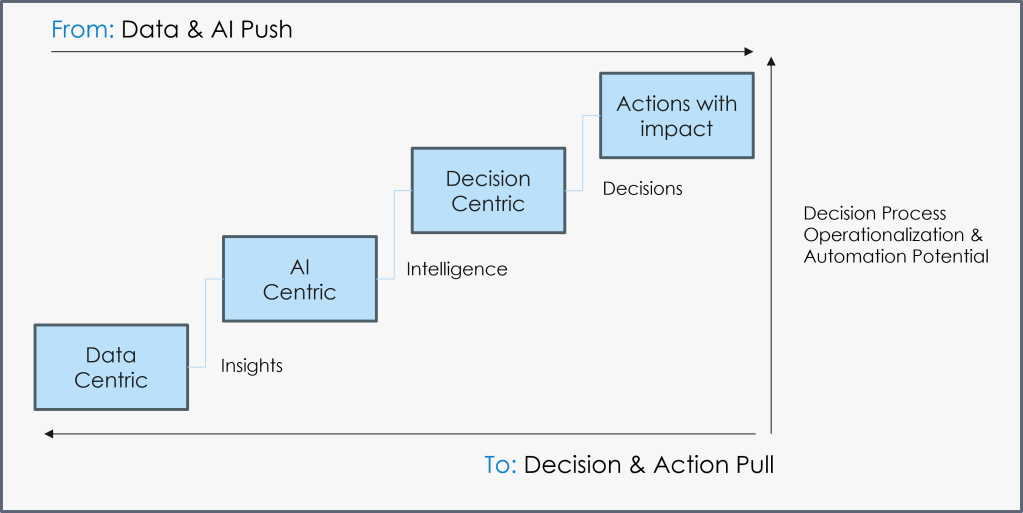

Once we’ve narrowed the scope of proving outside-in planning & decision making we can map the data to action process. As I highlight in below schematic, only a decision & action pull approach makes digitization, automation and operationalization of the data-to-action process possible. A data, planning, analytics or AI push cannot. This includes bi-directional demand & supply stream orchestration.

Once we segment our demand & supply streams and choose some relevant decisions, a lot of the data to action process can be automated by intelligent workflows. We can then add intelligent agents that autonomously forecast, plan, analyse options and guide a human to make decisions or take decisions and act autonomously. Decisions & actions can be triggered by either demand or supply variations (bi-directional). This can be achieved with current available technologies.

Outside-in thinking has been around for decades. Lora has developed a strong framework. Proving this outside-in framework by eating the elephant has not been successful for many years now.

Maybe we have to consider a decision centric and bite-sized approach to eat the elephant.

One thought on “Outside-in planning: a big elephant that needs a bite-sized approach”