Summary this article discusses how AI decision agents will help evolve demand planning from a function focused on creating a point plan, to a gap detection, gap closure and decision management function, where demand planners provide cross functional aligned decision input to the Demand Review with significantly increased speed, consistency and accuracy. It highlights how demand planning decisions will be digitised, augmented and status managed for increased planning decision control and visibility, and will elaborate on how demand planners will continuously learn with decision agents to make better plans and higher quality decisions.

Key Elements of a new Demand Planning paradigm.

- The need for decision centricity in demand planning

- Automation as foundation of demand planning

- Progressing to planning decision augmentation

- Decision Centric Scenario Planning

- Managing demand planning decisions

- Decision Centric Learning

- The changing role for the demand planner

- What’s Next? The rise of agency in demand planning

The need for decision centricity in demand planning

In 1960, just 6% of jobs required core decision-making skills, where by 2018 this number had reached 34% (Agrawal and colleagues, 2022). Decisions and decision-making practices have clearly become more important in the last 60 years, and we can expect this to continue. A logical conclusion from this trend is that organisations, including the planning function, must become more decision centric. “Ultimately, a company’s value is just the sum of the decisions it makes and executes” (Blenko and colleagues, 2010)

Integrated Business Planning (IBP), the matured concept of Sales and Operations Planning (S&OP), which saw its incarnation in the mid-1980s, has been implemented across the world across industries in most multinational companies. IBP is first and foremost an executive decision-making forum. The IBP team facilitates a structured, often monthly dialogue, to align executive decision makers, functional leaders, and subject-matter experts – to make critical business decisions. The IBP process supports a feasible plan, a rolling financial forecast, enterprise resource reallocation, and strategic alignment in a 3 to 24 months horizon. Within the 3 months, we define a short-term Sales & Operations Execution (S&OE) horizon. Decisions in this horizon are usually out of scope for the IBP process, and ought to be managed by separate short-term processes like demand sensing and supply balancing responses.

The Demand Review is an important meeting as part of the IBP process. The Demand Review is facilitated by a Demand Manager and chaired by the business owner of the top line of the P&L, often a sales director. A key objective of the Demand Review is to assess if the current Demand Plan is on track to meet committed sales volume, value and margin targets. The guiding targets can come from the annual operating plan, or the latest quarterly market update. The sales director presents the status of his final agreed plan to the owner of the full P&L, often the CEO, in the executive IBP meeting. As preparation for the executive IBP meeting, the sales director needs to get answers to the following key questions in the Demand Review:

- How are we performing? Have we been meeting our commitments so far?

- Is the plan valid? Is it based on real activities and sound assumptions that we believe?

- Is the plan enough? Does it meet my commitments to the business?

- What are my risks & opportunities? What scenarios could unfold for which we have to prepare contingency plans or which we can exploit for upside?

- What decisions need to be made? What decision do I need to make to deliver this plan, get back on track, stay on track, stay ahead of target and minimise risks?

- What can we do better next time? What have we learned, how can we improve?

The demand planning function ought to provide periodic performance insights and analysis, valid plans, scenarios to analyse opportunities or protect against vulnerabilities in the plan. If gaps are detected to top-line commitments, recommendations with decision options must be provided to the sales director to close these gaps.

Since the inception of S&OP, the preparation of the Demand Review has been a cumbersome, time consuming, mostly manual exercise for demand planners. With time spent mostly on creating a demand plan and reports, rather than on decisions.

Using decision intelligence, demand planning can become more digitised, automated, augmented and decision centric. Gap detection can be largely automated, gap closure can be augmented, decision agents can be used for decision alignment, and decisions can be digitised and status managed transparently. This will change the demand planning paradigm and make the demand planning function truly decision centric and more engaging for the demand planner.

Automation as a foundation of demand planning

A demand planner used to periodically analyse different forecast algorithms, tune parameters, and maybe select different internal and external data sources to develop a more accurate forecast. In recent years, near autonomous forecasting, which automates forecast data ingestion and preprocessing, auto machine learning algorithm selection and hyperparameter tuning and finally, automates forecast post-processing, has helped planners become more productive. We can now assume this automation is a standard in advanced planning environments. And that explainability of the chosen ML algorithm and forecast influencers is included to build trust with the planner. A metric that can be used to measure the autonomy of the forecast is NTF% (No Touch Forecast %). This is the percentage of forecast combinations, or forecast grains, that is not touched by a planner.

A ML forecast is not always superior. A planner might have additional timely product, customer or external information beyond the data the ML algorithm uses and needs to be able to make judgmental changes to the ML generated baseline. Or a planner can be prompted to review the forecast, when an automatically generated ML baseline forecast deviates significantly from the previous forecast. However, as human adjustments have a high risk of bias, judgmental changes to the (1-NTF%) baselines should only be done by exception and preferably where intervention could be based on predicted positive impact to the Forecast Value Add (FVA).

To answer the question: how are we performing? We can expect that in advanced planning environments, descriptive and diagnostic analytics and performance reporting are largely automated. This should not be limited to operational demand planning KPIs like accuracy, bias and FVA, but also include management reporting to display impact on more strategic balanced scorecard metrics.

Both forecast and analytics automation are a foundation to modern demand planning. It frees up a significant amount of time for demand planners, who can spend up to 50% of their time on gathering and manipulating data, before even making a forecast or report.

Demand Shaping Building Blocks

A forecast, even with the most complex Machine Learning algorithms using different internal and external influencers, is a calculation or estimate of future events (Oxford Dictionary). In most businesses this means an auto ML forecast is simply a baseline as input to a more encompassing demand plan.

On top of the baseline forecast, in most industries, the sales, marketing and other departments want to add activities to shape customer demand to increase sales and drive growth. These demand shaping building blocks can be depending on the industry, and are not limited to; new product introductions, temporary price changes and multibuy promotions, product distribution changes, range increases, marketing advertisement, trade spend phasing, field team activations.

At a more strategic level there might be the entering of a new market, or the exit of a product category. These plans, some of which can be significant, are not captured in an auto ML forecast and hence are required to be added to the baseline forecast to create the demand plan.

The demand plan needs to be able to incorporate any type of building block. Some building blocks might be integrated from other sources, like a trade promotion system. Some building blocks might be uploaded by flat file, some might be manually added. All building blocks and activities need to be supported by transparent assumptions to answer the question: is our plan valid?

Even an automated ML baseline forecast and highly effective management of demand planning building blocks, do not help the demand planners to effectively detect demand gaps and prepare better decisions in support of the Demand Review.

Progressing to planning decision augmentation

Where analytics, reporting & forecast automation and demand building block management are essential foundational capabilities, the next step is demand planner decision augmentation. David Pidsley, Decision Intelligence analyst at Gartner, highlights that when using artificial intelligence (AI) for decision making, augmentation is the higher goal to automation. Similar views are being held by supply chain professor Nada Sanders, who asserts that human-AI collaboration results in superior results, versus too much focus on automation only.

A planner can be augmented to understand if our plan is enough, and meets the latest committed targets, and take actions accordingly. A new demand plan must be measured against the latest published company commitments. As soon as a forecast is created and the demand building blocks finalised, we can measure volume and value gaps in the current plan versus target, like the company’s Annual Operating Plan (AOP). Rather than a planner having to find demand gaps manually in a planning book, following alerts or color-coded fields, a gap closing decision agent will be used to augment the planner.

The agent will: detect the size of the gap automatically, gather relevant data, evaluate feasible options and recommend the best option to the demand planner. To build confidence and trust during the decision-making process, the demand planner will be presented with all the underlying analytics during the decision-making process. After reviewing the supporting analytics, the demand planner only has to accept, reject or modify the recommendation to update the plan. If alignment is required with other functions like finance, sales or marketing to agree with the gap closing decision, or when a decision impact has significance beyond an agreed value threshold, a workflow can be generated to other Demand Review stakeholders to sign off the decision.

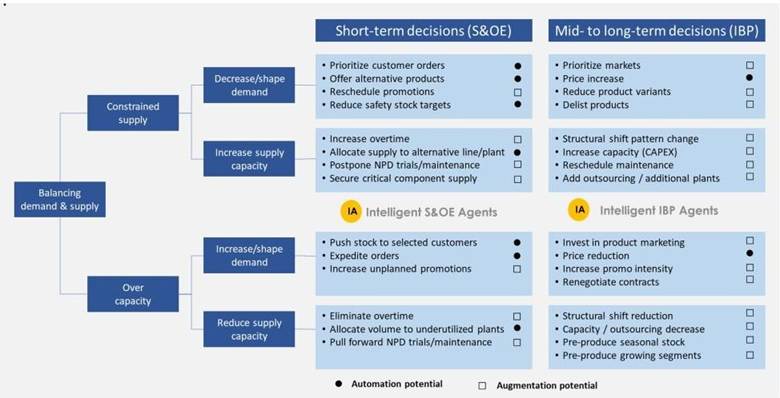

While IBP decisions are less frequent than S&OE decisions, they tend to recur across cycles. As illustrated by a 10-year-old schematic from a global beverage company, a projected demand-supply imbalance triggers a limited set of possible decisions to address the issues.

In reality, many demand gap closing decisions are recurring time and time again and hence can be digitised and orchestrated by a decision agent. Common demand planning gap closing decision are:

- Temporary price reduction to increase demand

- Optimise and rephase existing promotional plans

- Increase promotion intensity

- Social media or product marketing spend changes

- Rephase of New Product Introductions

Most businesses have performed these types of demand shaping actions many times over the years. Once digitised, it can be evaluated which ones are most successful. To choose between options, boundaries between sales volume, margin and the cost of a gap closing activity can be established . This will guide the decision agent in how to trade-off between options before presenting it to the demand planner.

Having a demand planning gap automatically detected, with a solution recommended in seconds, will free up a significant amount of detection and analytics time for the demand planner, but also for other Demand Review stakeholders. It further reduces the need for time consuming collaboration across functions for every gap, as the decision logic and underlying analytics has been agreed upfront during the design of the decision agent.

Using the gap closing agents not only accelerates decisions as input to the Demand Review significantly, it also makes them more consistent and in a digitised format transparent and auditable.

Decision Centric Scenario Planning

Scenario planning is an essential capability in the demand planning function. It can evaluate multiple options around vulnerabilities in the plan in order to protect from a downside. On the other hand, scenarios can clarify multiple options to exploit opportunities in the market. Scenarios support the Demand Review question; What are my risks & opportunities?

Scenarios only contribute to improved decision quality if the options to choose from are sufficiently different from each other. Hence, scenario capability needs to be flexible enough to support a wide range of options in an easy fashion for the demand planner.

Common reasons for scenario planning:

- Unique external events: COVID, significant weather events, strikes

- Unique internal events: new category or market entry

- Recurring external events: Seasons, Christmas, Chinese New Year, competitor actions

- Recurring internal events: Product quality issue, new product introductions

- Decision preparation: assess sensitivities around known plans & recurring decisions

Although demand planners ought to be able to freely assess unique or recurring scenarios, scenarios are most useful when part of a decision-making flow, where decision making criteria are agreed, decision objectives are clearly defined and scenarios are sufficiently different. If this decision centric guidance is not clear, scenario planning can become just another activity for an overworked demand planner that does not contribute to better decision making.

Scenario planning is most decision-centric when they are automatically integrated as part of a decision agent’s recommendation and decision flow. Within a digitised decision flow, with agreed decision objectives and trade-offs, the scenario planning process can be automated, significantly speeding up the process. A decision agent can run automated scenarios when a gap is being detected and share these with the planner for further review and final tuning before approving the preferred scenario as part of a decision flow.

By making scenario planning more decision centric, decision speed and quality increases, and hence the value of scenario planning.

Managing Demand Planning Decisions

The evolution to a more decision-centric demand planning function will need to be supported by improved visibility, accessibility and auditability of decisions made during a planning cycle. Management of decision status, progress and impact will become a key requirement in a decision centric demand planning function and an important addition to the role of a demand planner. Decision centricity goes beyond the question asked in the Demand Review; What decisions need to be made?

When every detected demand gap and gap closing decision is digitised, it becomes easy to create transparency and visibility amongst Demand Review stakeholders. Using a digitised Demand Review decision log, demand managers can monitor unresolved decisions by sorting the decision log based on function, impact, urgency, or other criteria.

By simply sorting the Demand Review decision log by time urgency, value impact, likelihood of success, or other criticality criteria, the demand manager can prioritise critical decisions and escalate them to the Sales Director without waiting for the next Demand Review, thereby accelerating decision velocity. Supporting metrics can include; number of gaps detected, % gaps closed, value and speed of gaps closed.

When company objectives change, digitised Demand Review decisions and their supporting decision agents may require adjustments to align with the new direction. It becomes the role of the demand manager to facilitate updated assumptions, decision policies, decision goals, and targets across functions. Decision boundaries, as well as automation and augmentation thresholds for the decision agent, might need cross-functional renegotiation. After facilitating these updates, the demand manager can maintain decision agents in a control room to ensure decision-making stays aligned with the company objectives.

Decision Centric Learning

In traditional demand planning there is limited learning from judgmental changes or gap closing decisions made. There can be some static FVA reports where planners can assess what role adds value to the forecasting. There are usually no data points about decisions made and no formal decision quality or decision learning conversations. There is no decision centric answer to the Demand Review question; What can we do better next time?

With Decision Intelligence, continuous learning in demand planning will take a leap forward. On a personal level, planners will have the opportunity to learn from historical manual adjustments made. Forecast Value Add (FVA) will become more personalised and FVA insights more dynamically provided during the recommendation and decision process. At any time, we can expect that planners can review their own FVA heatmap by product, customer or location to understand where they historically have added value to the forecast.

FVA insights can be made more dynamic and effective by including these during the judgmental decision process. When a planner is about to make a judgmental change and historical analysis indicates that the planner’s judgment is likely to be non-value-adding, an alert (in behavioural economics a ‘nudge’) can influence a planner’s behavior to rethink the adjustment decision. Having continuous insight in the historical impact and the value of one’s judgmental changes, increases the planner’s self-awareness, which over time can lead to reduced manual intervention where they don’t add value.

Very few companies record their Demand Planning decisions, let alone digitise them. Doing so will unlock another learning opportunity. By recording every gap detected, and every gap closing decision and its context, machine learning can be applied to classify decisions and their outcomes to calculate the probability of a good gap closing decision. During a gap closing decision flow, this provides a probabilistic data point that guides the planner to make better decisions.

Continuously learning from personal Demand Planning judgments and gap closing decisions will over time create better, less biased plans, and increase decision quality. It is a great example where humans and machines can collaborate and learn together to improve and gives an indication on how the role of a demand planner will change.

Changing role for the demand planner

In a highly automated and augmented demand planning environment, where agents detect gaps and make gap-closing recommendations, the role of the demand planner will adapt and become more strategic and engaging. Examples of role changes are:

Data architecture: The transactional role of data gathering, cleansing, manipulating, and planning parameter maintenance can be largely automated. This will shift to having a more architectural overview about what internal and external data sources influence the demand plan and how they are made available for the forecasting algorithms and demand building blocks.

Automation: Descriptive, diagnostics and performance analytics will be largely digitised and automated and made available for Demand Review stakeholders. It becomes the planner’s role to find efficiencies and incremental levels of data, analytics, planning and decision automation.

Decision management: managing the Demand Review decision library with gaps detected, decision status, and decision impact and priority. Capturing knowledge and decision learnings will become a focus. Decision speed and quality will become part of the demand managers’ performance criteria.

Decision architect: automatic gap detection and augmented gap closure will free up the time otherwise spent on these activities. The role will shift to finding new opportunities to define agents that close recurring gaps and align around the design of these agents across functions.

Interpersonal: Maintaining horizontal, cross functional and vertical, strategic alignment as a planner remains critical. Members of the demand team must be able to effectively work with other functions under time pressure. For the Demand Review, however, the focus will shift to periodically negotiate cross-functional policies to guide gap closing decisions agents, rather than negotiating every gap from scratch.

Agent (AI)-collaboration: agents require guidance around what goals they need to achieve. It becomes a demand manager’s role to maintain decision agents with new strategic priorities, trade-offs and logic changes, or cross-functional decision policies. In return the demand planner can learn from agent feedback about FVA, bias and decision quality.

When demand planners adopt a mindset that embraces AI, decision agents and this new way of working, the future of the demand planner role will become more strategic, influential, engaging and rewarding. Working with decision agents will create a bright future for the demand planner.

What’s Next? The rise of agency in demand planning

The use of Natural Language Processing (NLP) in combination with Large Language Models (LLM’s) applied to a company’s own data, provides a near-friction interface for the demand planner. We can expect that advanced user interfaces provide a demand planner to type a prompt or verbally give instructions to get a report with descriptive insights around demand performance KPIs, predictive insights around the current plan, and decision insights around gaps outstanding, decision status, decision speed and quality.

A common question in the Demand Review is; ‘What has changed since last month?’. It used to be a time intensive effort to compare plans and summarise the key differences. With the use of an LLM on the history of demand plans, KPIs and gap closing decisions made, a demand planner can create these insights in mere minutes.

However, with the use of LLM’s, we can also improve reasoning, and orchestration of more complex decisions across multiple decision agents. Agents can perform autonomous tasks but also take on the role of a persona or multi-agents can act as a digital team.

In the Demand Review, we seek operationally integrated, feasible demand plans, with functionally and strategically aligned decisions, that use healthy data as input. Therefore, some relevant applications of agentic AI for demand planning are the following:

Data management: a data agent makes sure that structured and unstructured external or internal forecast data is properly validated, labelled and published, before a forecast agent will use it to create a baseline forecast.

Operational integration: A demand feasibility agent can evaluate if upstream (production capacity, sourcing) or downstream supply chain capabilities (warehousing, transport) can support gap closure decisions and reports back to a gap closing agent if it is feasible and hence, valid.

Functional alignment: the closure of a detected demand gap can be negotiated between a sales agent and a demand manager agent. Both stay in their predefined boundaries to come to a solution. If the agents can’t agree, they escalate for a final decision to a sales director agent.

Strategy alignment: a sales director agent will check with a strategy or balanced score card agent, to assess if decisions are aligned with the strategic intent of the company and provide feedback to lower hierarchy agents accordingly.

The applications of multi-agentic AI to support demand planning are many. However, we need to acknowledge they are at the high end of the demand planning maturity journey and need to be treated accordingly in a demand planning roadmap.

Conclusion

For too long, talented demand planners have been trapped in roles that undermine their potential and waste human capital. By changing the planning paradigm, using carefully segmented and implemented planning automation, augmentation, and progressing to agent intelligence— we don’t just transform demand planning and make it more engaging, faster and more accurate. We will transform what it means to be a demand planner.

One thought on “The Evolution of Demand Planning: Augmentation & AI-Agents ”